A new Housing and Productivity Contribution will be introduced on 1 October 2023 that affects most new development. From the 1st October 2023, most new Development Applications in the Greater Sydney, Illawarra-Shoalhaven, Lower Hunter and Central Coast regions need to pay the Housing and Productivity Contribution on top of the existing Local Council Section 7.11 Development Contributions.

The Housing and Productivity Contribution replaces the previous Special Infrastructure Contribution (SIC) in the NSW planning legislation. The NSW Government is introducing the Housing and Productivity Contribution as a development charge that will help fund the delivery of infrastructure in high-growth areas across the State. The NSW Government believes the new system will be simpler and fairer, through a modest charge levied across a broader base, increasing investment certainty, and supporting connected communities. The purpose of the new Contribution is to fund State Government infrastructure such as roads, parks, schools, and hospitals and is a separate contribution to local contributions levied by Local Councils. The NSW Government notes that the scheme has a clear objective to provide housing and economic activity in urban regions through the contributions developers will make.

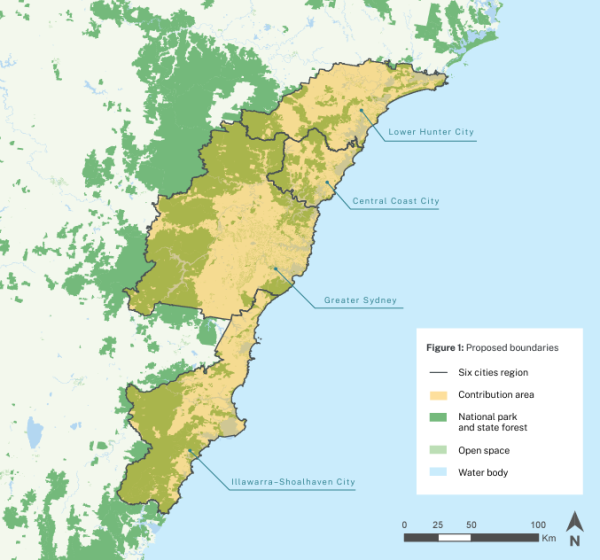

The Housing and Productivity Contribution will apply a broad-based charge to the whole of the local government areas located within the Greater Sydney, Illawarra-Shoalhaven, Lower Hunter and Central Coast regions, as shown in the map below.

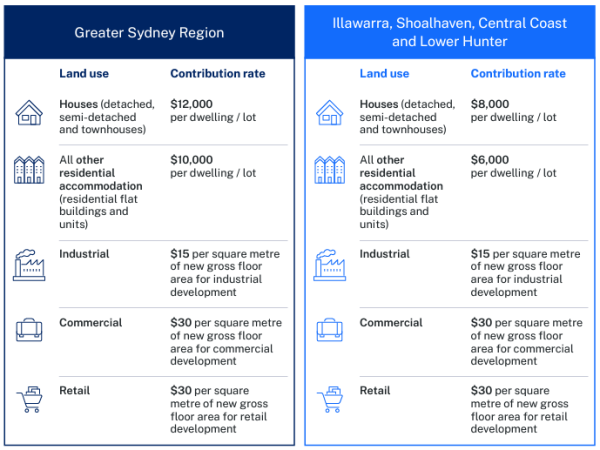

The Housing and Productivity Contribution will apply to:

- residential development that intensifies land-use where new dwellings are created, such as residential subdivision, houses, apartments, terraces and dual occupancies.

- commercial and retail development such as shops, neighbourhood shops, supermarkets, and commercial office buildings where new floorspace is created.

- industrial development such as warehouses and industrial buildings, where new floorspace is created.

The contribution will not apply to replacing existing houses (knock-down/rebuild).

Some types of development may be exempt from paying the contribution. This may include public housing, seniors housing (within the meaning of the Standard Local Environmental Plan), affordable housing and secondary dwellings (sometimes called ‘granny flats’) carried out under the Housing State Environmental Planning Policy (SEPP).

For commercial, retail, and industrial development involving construction only, the contribution must be paid before a construction certificate is issued. For residential subdivision development, the contribution must be paid before a subdivision certificate is issued.

A person cannot appeal to the Land and Environment Court in relation to a condition on a development consent or a complying development certificate requiring a HPC (see proposed section 7.30 of the EPA Act)

The NSW Government are developing a digital tool to allow for contributions to be calculated online. This tool will be integrated into the NSW Planning Portal and automates the ongoing administration, tracking and reporting of contributions.

Contributions will help fund state and regional infrastructure needed to unlock development and support forecast growth, such as roads, parks, hospitals, and schools. According to the NSW State Government, infrastructure investment will align with timeframes for land use planning, rezoning and forecast development. The Housing and Productivity Contribution can contribute towards the following growth-enabling types of infrastructure:

- Active transport

- Transport

- Education

- Health

- Emergency

- Justice

- Open Space and conservation

Funds will also be provided to support councils in delivering infrastructure that supports housing and productivity.