Rental values on the up as investment properties Throughout the previous property upswing absorbed.

A quarterly review of national rents by CoreLogic showed that rents surged 0.5% higher over the month to January 2020 to record a current median rental value of $440/week. This was the highest monthly growth rate in the national rental index since January 2018.

Eliza Owen said, “It is clear that the rental market is starting to gain momentum again as the investment properties from the previous upswing are absorbed, and new development levels have moderated. This means tenants can expect higher rents in most capital cities.”

The CoreLogic hedonic rental index has been in an upswing since September 2019. It follows the start of the rise in purchase prices in June 2019, and a decline of new dwelling construction in most capital cities.

Across the combined capital cities, rental rates were 0.5% higher over the month, with a weekly median rental value of $467. This is now $82 higher than the combined regional markets, where the median rental value sits at $385/week.

The difference between capital city and combined regional rents narrowed against high levels of new supply in capital city regions, which slowed rental growth. Now that the lack of supply is starting to tighten rental markets in capital cities once more, this dynamic may change over 2020.

Sydney is the most expensive city for rentals with a median dwelling rental value in January 2020 of $574/week. This is despite downward pressure on rents from high levels of property investment during the 2012-17 upswing. Year-on-year, Sydney rent values have fallen, but the rate of decline is shrinking. Median rents across Canberra came in only $18 lower than Sydney, making it the second most expensive market to rent a dwelling across the nation.

Rent Review Highlights:

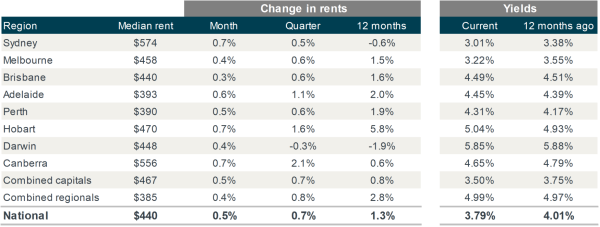

- National rents increased 0.5% over the month of January, and increased 0.7% on a quarterly basis to be 1.3% higher over the year.

- Capital city rents are 0.7% higher over the quarter and 0.8% higher year-on-year while regional market rents are 0.8% higher over the quarter to be 2.8% higher over the past 12 months.

- Each of the capital city dwelling markets experienced a month-on-month increase in rent values, led by Sydney, Hobart and the Canberra where rent values were up 0.7% in January. However, Sydney was one of two capital city markets to still have lower rent values year-on-year.

- In January 2020, Sydney remained the most expensive rental market, with a current median rental value of $574/week. The differential between Sydney and the second most expensive rental market, Canberra, has trended down over time. As Canberra rents increased to $556/week over January, the difference between the two was just $18.

- Darwin was the only capital city to see declines over the three months to January (-0.3%), and saw the largest rental value decrease over the year (-1.9%).

- Gross rental yields are currently recorded at 3.79% nationally compared to 3.81% at the end of the previous month, and 4.01% a year ago.

- Rental yields were higher over the year in Hobart, Perth and Adelaide, but declined in the rest of the capital city markets.