Spring is traditionally the busiest time in the Australian property calendar, and 2025 is no exception. As the weather warms up, so does the market, with more listings, heightened competition, and plenty of eager buyers looking to secure their dream home before the end of the year.

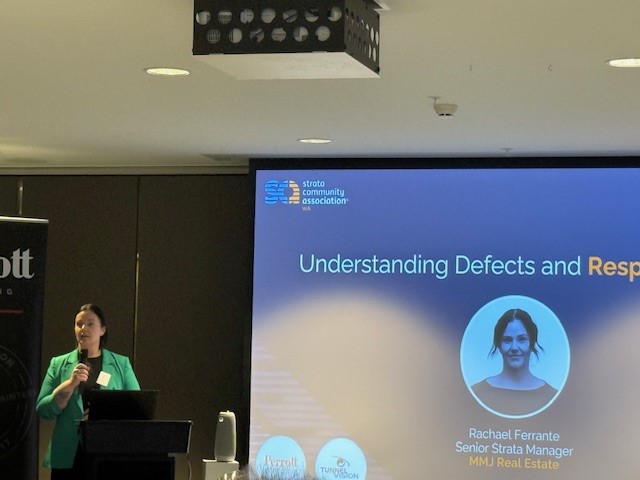

MMJ Real Estate's own Rachael Ferrante was recently invited to speak at the Strata Community Association WA (SCAWA) workshop, where she contributed valuable insights during an interactive session focused on building defects — one of the most complex and pressing issues facing strata managers and owners’ corporations today.